What Makes Up an Effective Invoice?

An effective invoice includes helpful contact information, a description of services provided, specific costs, and more.

While you may find it easy to gain customers who want your goods or services, perhaps you’ve noticed that getting paid for your work can be a bit more complicated.

Within the last several years, small to medium business owners have seen only around 40% of invoices being paid on time.

If you’re a part of that category, you likely understand the financial frustration and strain that late invoice payments can bring.

One of the best ways to create and maintain a successful billing process is by designing effective invoices with specific details that make it quick and convenient for your customers to pay you. Here, you’ll learn exactly how to go about this by understanding the six essential elements to include in an invoice, increasing your chances of getting paid on time.

Jump to:

-

How To Create a Quality Invoice

-

1. Establish a Unique Numbering System for Each Invoice

-

2. Include a Business Name, Address, and Other Relevant Contact Information

-

3. Provide a Detailed Description of the Project, Goods, or Services

-

4. Add Important Dates and Costs for Services

-

5. Insert Client or Company Name and Contact Information

-

6. Incorporate Payment Options and Briefly Explain Payment Process

-

-

Tips for Fine-tuning Your Invoice Management

-

Bring In More Revenue With Better Invoicing

How To Create a Quality Invoice

It may seem easy enough to enter basic information to your invoice about the work or goods you provided, send the invoice to the customer, and assume they’ll pay you by the due date. But this business workflow isn’t always so cut-and-dry, and the information on your invoices may result in customers feeling confused and possibly paying late, if at all, which can negatively impact your business.

When you create an effective invoice, you’re essentially making it easier for your customers to understand what the invoice is for and how to pay you. Moreover, effective invoices also help you keep track of your business finances and administrative costs.

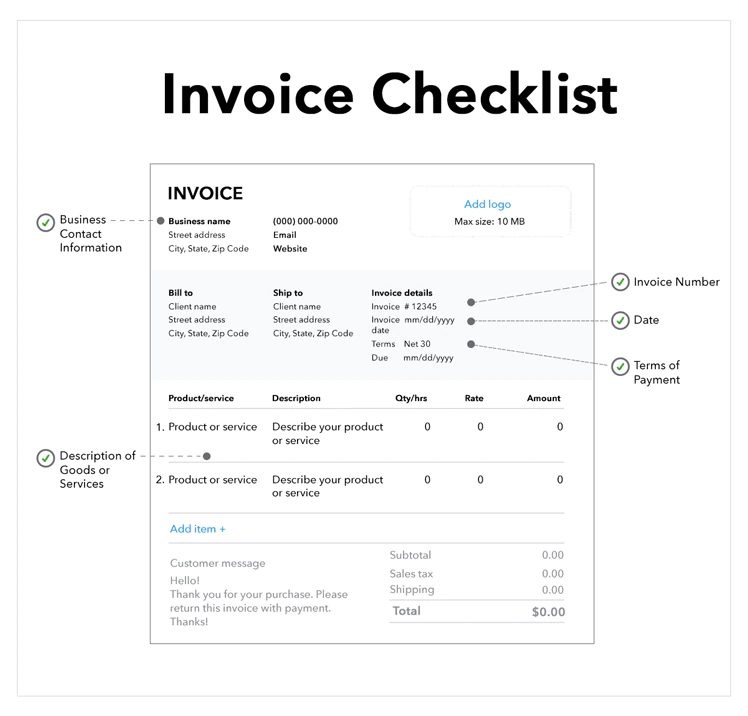

Source: Quickbooks

Source: Quickbooks

1. Establish a Unique Numbering System for Each Invoice

An essential part of keeping your invoices organized is to use invoice numbers. Invoice numbers can help you effortlessly track your payments and see key trends in your finances. It also makes it easier to send payment reminders, which can likely improve the odds of on-time payments.

You may choose to number your invoices in the following ways:

- Sequentially, by starting with one and moving upward

- Chronologically, by adding a date element to each invoice number

- Grouping them by letter or number codes assigned to each client

- Grouping them by letter or number codes assigned to different projects

2. Include a Business Name, Address, and Other Relevant Contact Information

While these details may seem obvious, it may be easy for you to overlook them when you’re busy with other company specifics. For example, if you use an invoice app to autofill your information, you may accidentally ignore minor mistakes and misses, such as interposed numbers.

Double-check your business information to make sure that your customer knows who is requesting payment and how they can contact you if they have questions. Waiting for a consumer request to give this information may be a sign of bad customer service, and you certainly want to avoid that.

3. Provide a Detailed Description of the Project, Goods, or Services

Quality, effective invoices include a description of the goods or services provided. Make sure your invoices have:

- A detailed description of what you provided for the customer

- The date on which you completed services or delivered goods

- How many units the customer ordered, if applicable

- Separate lines indicating or itemizing each good or service, particularly if customers order more than one product or service

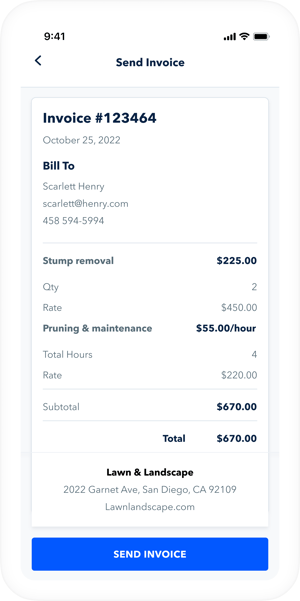

Source: GoSite Invoices

Source: GoSite Invoices

Avoiding these details could lead to problems down the road, such as customers questioning service descriptions. Therefore, aim for a clear, productive invoice to show your customers you care about their satisfaction. A seamless invoice only helps to make the payment process as easy as possible for customers.

4. Add Important Dates and Costs for Services

Most invoices include a minimum of two dates:

- Effective dates: The month, day, and year you created and issued the invoice. This date is typically after the service date.

- Service date: The month, day, and year in which you provided the service or delivered the goods. Sometimes the service date may be more than one day, and it may also match the effective date. This date is sometimes known as the “period of operation.”

However, perhaps your company offers a subscription to services or goods, and invoices for subscriptions usually contain more than the standard minimum of dates. While subscription invoices include service and effective dates, they also have other billing trigger dates, such as customer acceptance dates.

Customer acceptance dates indicate the month, day, and year your customer has agreed to accept your services or goods. This date may or may not match the effective date.

To make it easier for your customers to understand which dates mean what, break down what each date means on the invoice and the costs of your goods or services. This could include:

- Your base rate

- The price per unit

- The gross total before taxes

- Tax costs

- The net total that your customer must pay

If you offer customers discounts, your invoice is an excellent place to display how much you deducted from their bill — and how much they are saving. If your business participates in cost sharing, you may also want to include your cost share amounts.

When calculating your rates, consider your administrative costs and effective billing rate, which is your total revenue divided by your total working hours.

5. Insert Client or Company Name and Contact Information

Solid invoices include not only your company name, address, and contact information but also the customer’s address and contact information. Doing so helps ensure that you send the invoice to the right place. The customer can also use the invoice for tax or other financial purposes.

When a customer is unsure if an invoice is really for them, it could delay their payments to you and cause a customer service or satisfaction issue. Furthermore, correcting and resending an invoice can waste your valuable time, so verifying your customer contact information nips this in the bud.

6. Incorporate Payment Options and Briefly Explain Payment Process

Make life easy for your customers by clearly letting them know how they can make payments, and that may be in a few different ways depending on your business.

Consider offering various payment methods, letting your customer choose the one that’s most convenient for them. If you offer online payments, you may wish to send digital invoices and provide your customers with a hyperlink to your payment portal so you can get paid faster.

Source: GoSite Invoices

Source: GoSite Invoices

Some customers like the old-school methods of doing business, so it’s not a bad idea to issue paper invoices if that’s your client’s preference. Just remember that it may take longer for you to get paid if you invoice using paper.

Tips for Fine-tuning Your Invoice Management

Now that you know what to include in an invoice, assess the rest of your invoice management system to see if it benefits you and your customers.

Make Sure Your Payment Process Is Easy and Efficient

A part of good customer service is ensuring that your payment process is easy and convenient.

For starters, think about how your payment terms affect both your business and your customers when deciding what your terms will be. Payment terms should clearly define the following to your customers:

- When payments are due

- How to make payments

- The penalty for not making timely payments

Some businesses may communicate payment due dates using terms such as “Net 30” or “Payment In Advance." But, it may be less confusing to simply state an exact date. Also, some businesses are shortening their payment periods (or initial period) since faster payment options are available.

For example, the most popular payment period used to be 30 days to make their payments in full. But, with online payment methods, customers can make payments within minutes instead of mailing checks, which of course, takes much longer to reach you. Thus, you may choose to reduce customer payment periods.

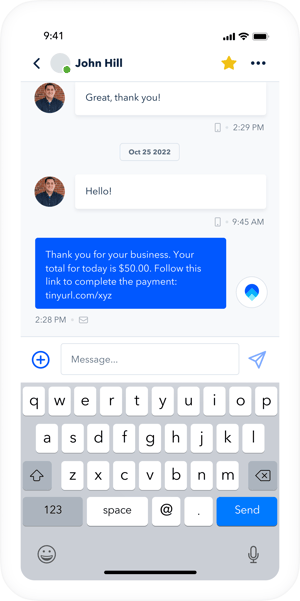

Source: Sourcing Allies Global

Source: Sourcing Allies Global

Offering various payment method options allows your customers to choose the one that works best for them. Consider accepting standard payment methods like cash and credit cards, but also open up to taking payments from digital platforms.

Today, fraud and identity theft are common, and some of your customers (and you, too) may worry about this if they make online payments. In fact, a study by Juniper Research predicts that over $343 billion will be lost by businesses around the globe between 2023 and 2027 because of fraud through online payments. So to provide your customers with security, use reputable payment options that won’t compromise financial information.

Provide detailed instructions on how your customer can make their payment, no matter which type you offer. For online paying, hyperlink to payment processing websites. Advise customers to whom they can make their checks out and where they can mail them.

Try Automated Billing and Invoicing To Save Time

Automated billing and invoicing can make transactions much more convenient for everyone. For example, your customer may save payment methods that you can bill automatically — practical if you offer subscriptions or have recurring clients.

Automating your billing and invoicing helps your clients make timely payments and can reduce errors during the invoicing process. Additionally, it can save on the time you would otherwise use for manually issuing invoices and payment reminders, and it doesn't usually require any specialized equipment. You can implement automation with the computer you already have and spend extra time on different tasks.

When you’re choosing a billing and invoicing automation program, consider the following:

- Is the program built for your industry?

- Can you integrate the program with other accounting software?

- Can you customize the customer portal the way you want?

- Can you edit invoices to meet your needs?

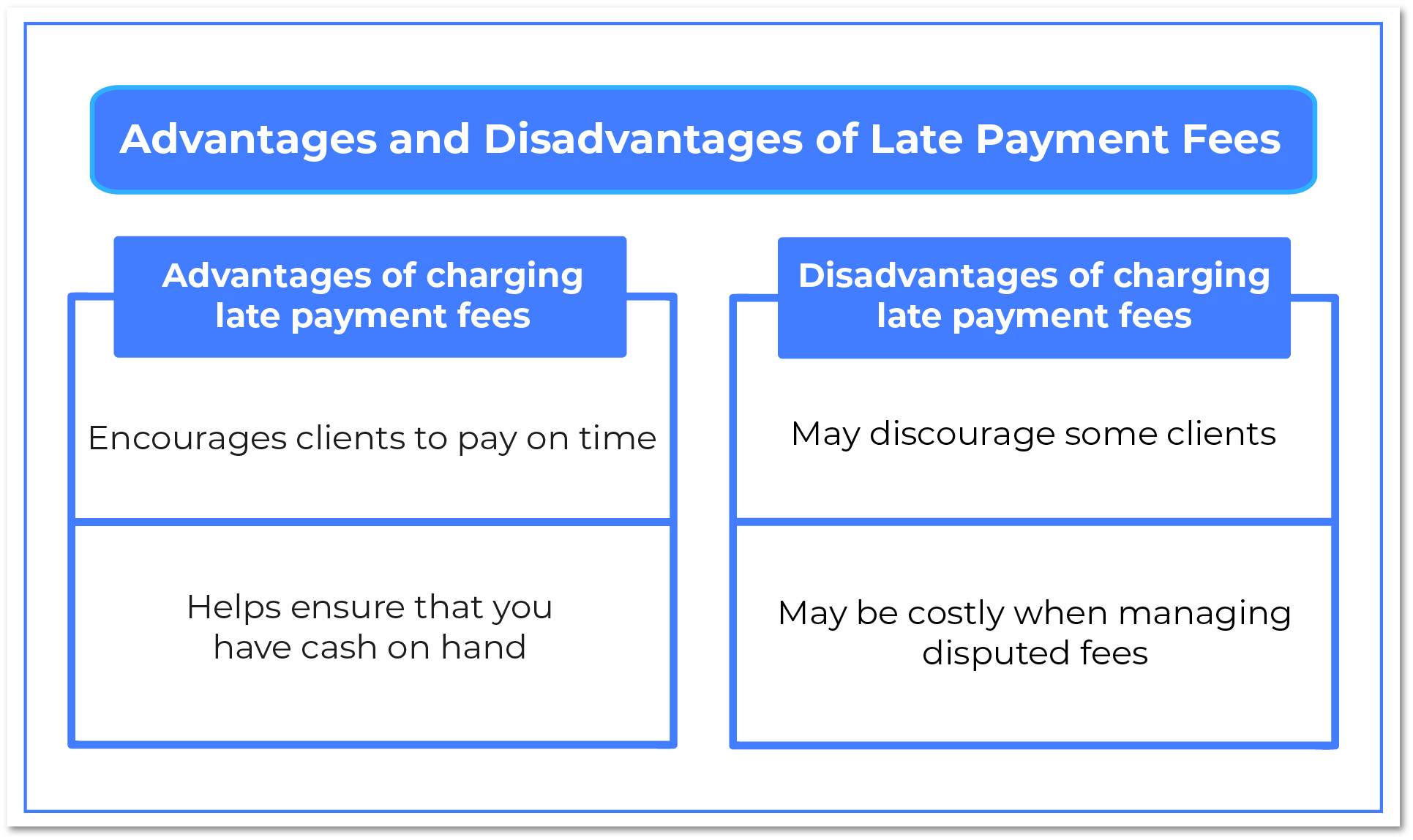

Be Upfront About Penalties for Late Invoice Payments

It’s a business best practice to have a late payment policy before sending an invoice. Depending on your business, you may charge a percentage or flat fee penalty as part of the policy. This is especially helpful for companies that have fluctuating invoice totals.

Source: Handle

Source: Handle

On the other hand, flat fee late payments can be helpful for businesses with fairly stable prices. Flat fees can also be set on a sliding scale basis so that you’re charging an appropriate amount for the invoice.

Once your policy is set, clearly communicate it to your clients. Invoices should allow your customers to see what will happen if they are late on their payments. Otherwise, unexpected fees could result in a consumer complaint.

It may be wise to place your late payment policy within your contract terms and have the customer sign it before you begin working together. Emails following up on invoices are also helpful in reminding your customers that they must make a payment.

Keep In Mind the Language You Use

All your invoices and client communications should be professionally worded. Though it can be difficult to remain polite with a client who has missed payments, it’s important that you use clear language to communicate the amount, how to make a payment, and the due date.

Consumer respect goes a long way. Using “please” and “thank you” when addressing your customers helps avoid conflict and show that you care about your customers.

Bring In More Revenue With Better Invoicing

A smooth invoicing process requires accuracy, efficiency, and timeliness. Even a seemingly minor invoicing error can negatively affect your cashflow and bottom line.

By upgrading the way you invoice, you’ll be able to serve your customers better, provide more payment options, and grow your base. Take the right steps to ensure you get paid on time, everytime, and run a more profitable business.

%20(1)%20(1).png?width=340&name=Group%2012%20(2)%20(1)%20(1).png)